Moneylion App Review – Loan Online Apply

1. What is Moneylion App?

Moneyline App is an online loan app that provides online loan services like finance, mobile banking, cash advances, investment, and many more. In this Post, We are going to Moneylion App Review.

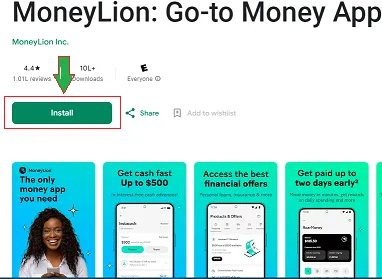

Money Line App was released on 19th May 2016. So far this app has got 1M downloads on the Play Store.

The app has a rating of 4.6 on the Play Store. This app provides support to its customers 24/7 hourly, through phone chat and email.

2. Benefits of Moneylion App?

24/7 Customer Service:-

- Moneyline App provides service to all its customers 24/7 hours via phone chat and email.

Roarmani:-

- Moneyline App is in One Banking App. This gives you the option to unlock zero% APR, and cash advances from $1 to $1000 with Recurring Direct Deposit.

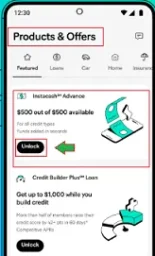

Instacash:-

- There are no interest, no monthly fees, and no credit check charges for up to $250 on this app.

Increase:-

- The Moneyline App provides the facility to automatically convert additional purchases and investments into the account.

3. Moneylion App Features Available?

-

This app provides faster access to funds as compared to paper checks vs. electronic deposits.

-

There is a 0% APR cash advance service offered by Moneyline. Which displays your available Instacash advance limit in the Moneyline mobile app, and changes the same from time to time as per the convenience of the customer.

-

This is based on your limit the transaction history of your deposit account and other factors determined by Moneyline.

-

There is no mandatory fee for this service. You can leave an optional tip and pay the optional turbo fee for faster money delivery. Which is $ 4.99.

-

There is no mandatory minimum or maximum time limit for repayment in Moneyline App. You are not eligible to make an advance request until your dues are paid.

4. How much loan can one take with the Moneylion App?

Anyone can get a loan of up to $1000 in the form of a personal loan. This helps you build your credit with a few taps on your mobile as a member of MoneyLion Credit Builder Plus. MoneyLion App provides loan services competitively without any credit inquiry.

5. How long can one get a loan from Moneylion App?

The minimum and maximum loan repayment period for all loans is 12 months, with no penalty for early payments.

6. What is the percentage of interest from the Moneylion App loan?

Fixed rates on Credit Builder PLUS loans range from 5.99% APR to 29.99% APR. The minimum and maximum loan repayment period for all loans is 12 months, with no penalty for early payments.

7. Example

If you take out a $1,000 loan with a 12-month tenor and a fixed APR of 29.99%, your monthly payment would be $97.48 ($72.49 principal plus $24.99 interest), with a total lifetime payment of $1,169.79.

8. Who can take a loan from Moneylion App?

Anyone can get a loan of up to $1000 in the form of a personal loan.

This helps you build your credit with a few taps on your mobile as a member of MoneyLion Credit Builder Plus.

MoneyLion App provides loan services competitively without any credit inquiry.

9. How to take a loan from Moneylion App?

- First of all, download the MoneyLion app from the Play Store.

- Then open the MoneyLion app and click on the sign-up option.

- Then click on the button for Credit Builder Plus Membership.

- And now link your checking account to it.

- Once you’ve linked your account to it, your loan offer will be displayed on the user dashboard, which gives you access to members-only tools.

- Now verify by reading this offer.

- After that, you complete the further process.

Thanks for your Support